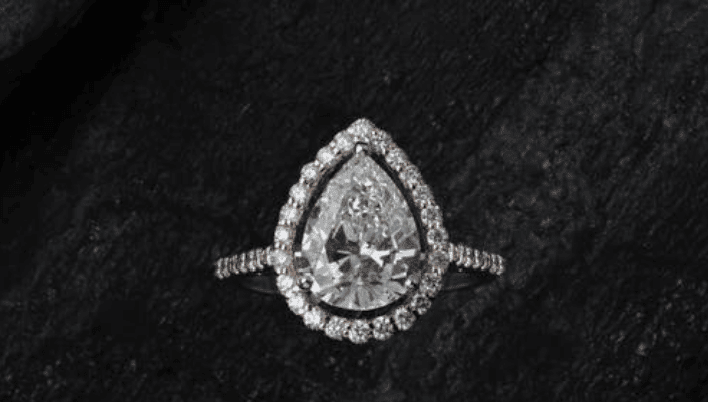

Humans are simple creatures. We like shiny things. For more than a thousand years, we’ve flaunted our jewels or lavished them on the people or animals we love.

Rings, necklaces, bracelets, earrings, or even crowns can be more than just bling. They acknowledge milestones, reward achievements, and symbolize relationships. They’re among our most precious possessions.

Your own treasured pieces of jewelry may be priceless and irreplaceable in terms of sentimental value. But you can minimize the financial harm that results from loss, theft, or damage.

Jewelry Warranty as a Limited Protection

A jewelry seller or manufacturer may offer a warranty. It’s only for newly purchased jewelry and probably only covers manufacturer defects — for example, your ring is delivered with a scratch or a loose stone. The warranty won’t cover theft or loss. And if the piece isn’t new or you’re not the original purchaser, you must find another form of protection.

Homeowner’s or Renter’s Insurance

Most homeowner’s and renter’s insurance policies offer coverage for jewelry, but it can be limited in three ways:

- Dollar amount. The policy specifies a maximum amount the insurance company will pay.

- Valuation method. The policy allows the insurance company to calculate loss payment based on an item’s actual cash value (ACV), which usually is less than the cost to replace it. For example, factoring in depreciation, the ACV of a 10-year-old necklace is $500. But the current cost to replace the necklace with one of similar type and quality is $3,000.

- Cause of loss and damage. For example, a policy may cover the theft, but not the accidental loss of an item of jewelry. The jewelry coverage in a homeowner’s or renter’s insurance policy often can be enhanced. Some companies offer endorsements or “riders” that can increase the amount of coverage on a specific item as well as broaden the valuation method and the causes of loss or damage.

Jewelry Insurance Policy

A separate policy for jewelry can be your best solution, for several reasons:

- Separate claim. Buying a jewelry policy avoids the premium increases or nonrenewal that may result from a homeowner’s or renter’s claim.

- No deductible can be an option with a separate policy.

- The broadest valuation options and causes of loss or damage are available because jewelry policies specifically address common sources of claims such as “mysterious disappearance,” and they routinely cover the replacement cost.

Protect Your Bling

Today’s annual pricing for a jewelry policy is usually $1 or $2 for every $100 that it would cost to replace. For example, if a ring’s replacement cost is $10,000, it would cost between $100 and $200 per year to insure it on its own policy. Discounts may be available for showing evidence of security, such as a home alarm system or storage in a safe.

An appraisal from a certified gemologist is required for a jewelry policy. The appraisal is used to determine the item’s replacement cost, not its current market value. Since the replacement cost of jewelry will vary over time, an appraisal is recommended (and may be required) every few years.

If you purchase a jewelry policy, be sure to notify your insurer of changes in ownership and address. For example, your mother’s heirloom necklace might currently be insured by her at her home address. Once it’s given to you, you must notify the insurer because it’s likely the policy will need to be changed or a new policy issued to keep coverage intact.

Lean on a Jewel of a Relationship

Your Jason Herman Insurance agent should be made aware of your new jewelry, whether it’s a new purchase or a family heirloom. Your agent will offer reputable advice on the best way for you to adequately protect it under your current policy or may recommend a new policy to insure it.